|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

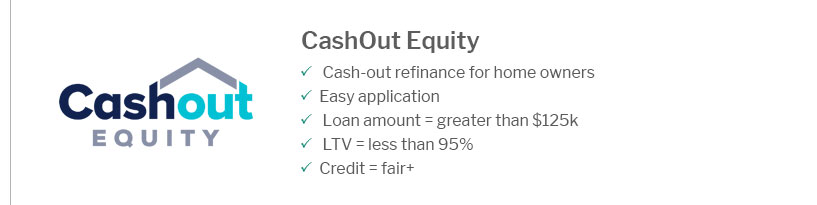

Understanding Cash Out Refinance for Home: A Beginner's GuideCash out refinancing is a financial strategy that homeowners can utilize to leverage the equity in their homes. By replacing their existing mortgage with a new, larger one, they can access the difference in cash. This guide provides an overview of how cash out refinance works and its potential benefits and risks. What is Cash Out Refinance?Cash out refinance allows homeowners to obtain a new mortgage for more than they owe on their current home loan. The difference is paid to the homeowner in cash, which can be used for various purposes, such as home improvements, debt consolidation, or other financial needs. How It WorksThe process involves applying for a new mortgage that exceeds the balance of the existing loan. Once approved, the borrower receives the difference between the two loans in cash. It's crucial to compare rates, such as 30 year cash out refi rates, to ensure favorable terms. Benefits of Cash Out Refinance

Risks and ConsiderationsWhile cash out refinancing can be beneficial, it also carries risks. Homeowners must understand these before proceeding. Increased DebtBy taking out a larger mortgage, you increase your debt and possibly extend your payment term. Risk of ForeclosureFailure to make payments on the new, larger mortgage could lead to foreclosure. Steps to Apply for Cash Out Refinance

Alternatives to Cash Out RefinanceIf cash out refinance isn't the right fit, consider alternatives such as home equity loans or lines of credit. Another option could be a 90 ltv refinance no pmi, which may offer different terms and benefits. FAQWhat is the minimum credit score required for cash out refinance?The minimum credit score for a cash out refinance typically ranges from 620 to 680, depending on the lender and loan program. How much equity do I need to qualify for a cash out refinance?Most lenders require at least 20% equity in your home to qualify for a cash out refinance. Can I use cash out refinance for investment purposes?Yes, the cash obtained can be used for various purposes, including investment opportunities. https://www.usbank.com/home-loans/refinance/cash-out-refinance.html

A cash-out refinance is a type of mortgage refinance that lets you convert your home equity into cash. It replaces your existing home mortgage with a new, ... https://www.nerdwallet.com/article/mortgages/refinance-cash-out

With a cash-out refinance, you get a new home loan for more than you currently owe on your house. The difference between that new mortgage ... https://www.pennymac.com/refinancing-products/cash-out-refinance

A cash-out refinance replaces an existing mortgage with a new loan with a higher balance, sometimes with more favorable terms than the current loan.

|

|---|